Table of Content

If you want to save on your home insurance policy, it may pay to inquire about the discount opportunities from the insurers or agents you are getting quotes from. Because of this high volume of losses, many insurance companies are implementing stricter policies on where homeowners insurance is offered. Some companies may deny coverage to certain ZIP codes entirely, or may opt to cancel or non-renew policies on homes located in high-risk areas in order to manage their own risk and financial solvency. When determining home insurance rates, most insurance companies will review the location of the home and the features of the surrounding area. As wildfires continue to get larger and more costly for the insurance industry, coverage denials and policy cancellations have become the norm.

Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. If your home is destroyed by a wildfire, home insurance can pay to rebuild your home, replace your belongings, and cover temporary living expenses while your house is being rebuilt. A condo insurance policy will cover fire damage to the “inside walls” of a condo. The homeowners association’s “master policy” generally covers the exterior of a condo, like the outside walls and roof. Collins of the APCIA noted a national shortage of construction materials, including lumber.

We work with the top insurance companies to deliver unbeatable insurance quotes.

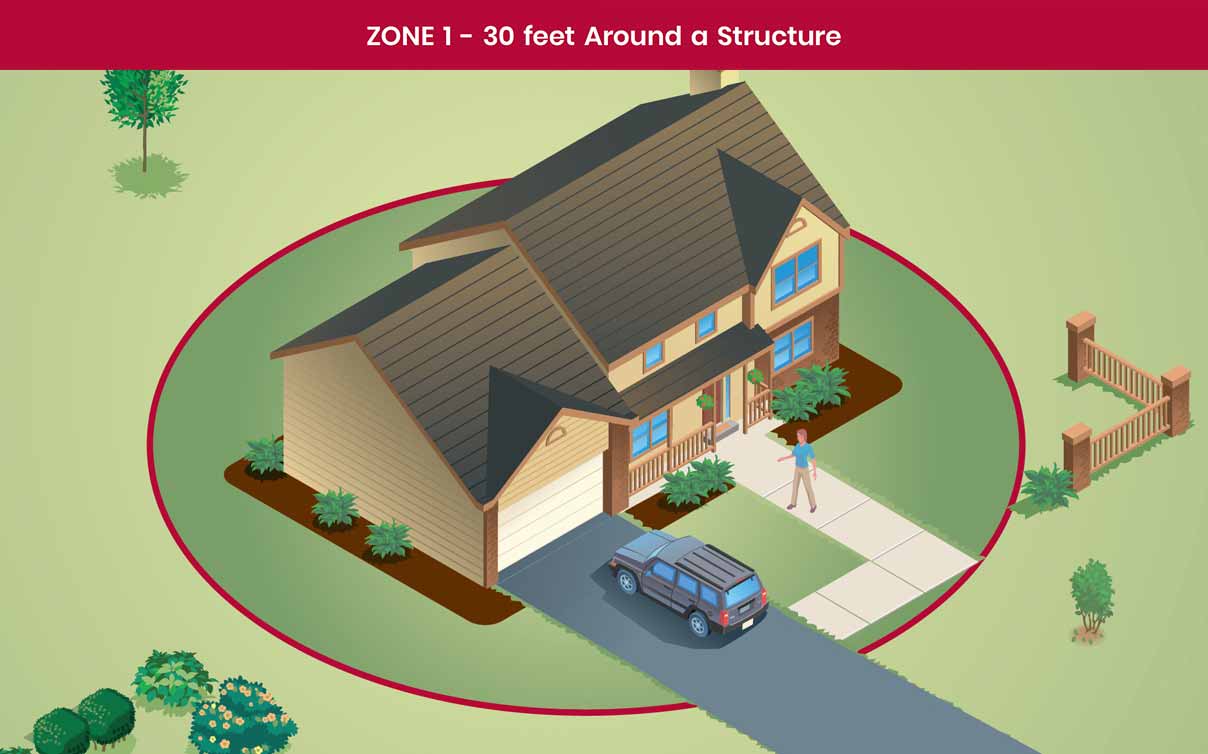

And that is why so many wildfire prevention tips deal with keeping embers out of your home and property. This link leads to an external site which may provide additional information. The Department of Forestry and Fire Protection cannot attest to the accuracy of a non-CAL FIRE site. Through a local review process, CAL FIRE has determined that this county has no Very High Fire Hazard Severity Zones in LRA.

Arson by the property owner is not covered by home insurance as this is an intentional act. A California Fair Plan policy can cover damage from Fire, Lightning, Internal Explosion, Smoke, Wind, Hail, Riot, Vandalism, Malicious Mischief, Aircraft, and Vehicles. We highly recommend pairing the CFP policy with a Difference In Conditions (DIC aka Wrap-Around) policy. The DIC policy covers items that the CFP doesn’t such as water damage (the #1 reason for home insurance claims), liability , and theft.

Time Zone in Frankfurt am Main, Hesse, Germany

As Managing Editor for SafeHome.org, Rob Gabriele has written and edited over 1,000 articles in home security. His expertise is in smart home automation and home protection with thousands of hours of testing and research under his belt. Formerly a reporter and producer for the USAToday network, Rob has been a writer and editor for over 10 years.

Always ensure that every part of your property is covered by your insurance policy. That said, it’s rapidly becoming clear that larger and larger swathes of California are at elevated risk of wildfires, so even areas that do not seem likely to have a fire could be affected in the future. Such is the case for areas like Paradise, which faced extensive loss with homeowners who were underprepared for potential fire damage. In any case, it’s important to double-check that your fire damage policy explicitly states that it covers wildfires, as well as fire damage. Although the average monthly cost for home insurance in California is around $100, if your area has a higher risk of wildfires, then your premium may reflect this.

Fireproof and Maintain Your Roof

We understand how time sensitive home insurance coverage can be and assign high brush risks top priority. While in many cases a temporary solution, purchasing homeowners insurance coverage via your state’s FAIR Plan could be one way to obtain coverage while you search for a permanent option. FAIR Plan coverage may not be as robust as a private insurer policy, however, and may also be more expensive than private coverage.

We have made strategic partnerships with leaders in the industry, securing carrier appointments with A+ rated insurance companies. We know California and the risks we face, we are always adapting to the new climate of risks. To homeowners who take extra steps toward fire prevention, which may help you offset increased insurance costs. What's more, it will simply keep your home safer from fire damage. Provided fire insurance and hazard insurance for a home in a high brush area where most other companies either...

Other structures coverage

Typically, home insurance companies cover wildfire damage. In the meantime, now is the time to start fireproofing your home. (In certain parts of California, you’ll find government rebates to help you along.) At the same time, if you haven’t taken a look at your homeowners policy in a while, it’s time to dust it off. Pay very special attention to dwelling and personal property coverage. The cost of fire insurance included in your homeowner’s insurance policy varies greatly in different areas of California.

For example, let’s say you pay a $3,000 mortgage monthly and your home is deemed inhabitable due to a water claim that saturated the entire first floor of your home. While the home is being dried out and put back together, you’ll need to find lodging while the home is being repaired. In most cases, you will want to stay in a hotel or a furnished property of similar lifestyle and building grade. In other words, if you were in a 2000 square foot modest home, the insurance will not provide compensation for you to rent a 3,500 sq. If you find a fully furnished similar style home for $4000 per month, the insurance company will provide $1000 extra per month for lodging (the difference between $3000 mortgage and $4000 furnished rental).

As wildfires become more common, more and more Americans are struggling to find homeowners insurance or being dropped by their insurance carriers. Over 4.5 million U.S. homes in 38 states are at high or extreme risk of wildfire, the Insurance Information Institute reports. Lemonade doesn’t cover the whole country, but it does cover California. Our Lemonade homeowners coverage guide will give you a nice taste of what their plans have to offer California residents.

Just pay close attention to other special limits outlined in your policy for shrubbery. Many insurance companies won’t pay more than $500 to $1,500 for any one tree, shrub, or plant. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

The claim process can be started on the phone, online, or in person. The sooner you start the claims process, the sooner you can benefit from your insurance coverage, such as using your policy for temporary housing. The reason why fire insurance premiums are steadily rising is that wildfires are becoming more common, more damaging, and harder to fight off. Naturally, because home insurance companies will need to cover that damage, the collective price for your policy rises to reflect the amount of damage your home may incur after a wildfire. The more likely your home is damaged by fire, the higher your premium will be.

FAIR Plans are generally expensive and can cost double what a typical homeowners insurance policy costs. Getting homeowners insurance in a fire risk zone is costly—but going without is risky. If your mortgaged home burns down, you'll still have to pay the mortgage or face foreclosure, which can severely damage your credit. Even if your home is paid off, any losses will come out of your pocket. This is why it's a good idea to put home insurance on older homes, even if they are paid off.

Time Changes in Frankfurt Over the Years

A standard homeowners insurance policy covers smoke and fire damage caused by wildfires. In California, Insurance Commissioner Ricardo Lara has ordered the state’s FAIR plan to offer broader coverage options to homeowners who are losing their home insurance because of wildfire risk. He wants the FAIR plan to modernize its policies, which have consisted of a fire-only plan and separate policies for liability and personal property, which drive up the cost. The formulas homeowners insurance companies use to determine their insurance rates are complex and constantly changing. But, all other things being equal, a lower PPC score for your area may translate to a lower homeowners insurance premium, as it means your home is at a lower risk for serious fire damage. Home insurance companies offer lower rates if you have a good ISO rating because a well-prepared fire department should be able to put out a house fire more quickly.

We have worked with Eric for several years and highly recommend his services. He is extremely knowledgeable and truly understands our needs, in order to make sure we get the best insurance coverages for our family. We have several policies that Eric has helped us secure, often in difficult situations, including our hillside homes in high risk fire areas. Eric is always ahead of it, he explains everything thoroughly, and he helps us make the smartest decisions. He and his team are responsive and attentive anytime we need advice or attention.

No comments:

Post a Comment